Off-Plan Real Estate in Dubai: Pros and Cons

What Does Off-Plan Mean?

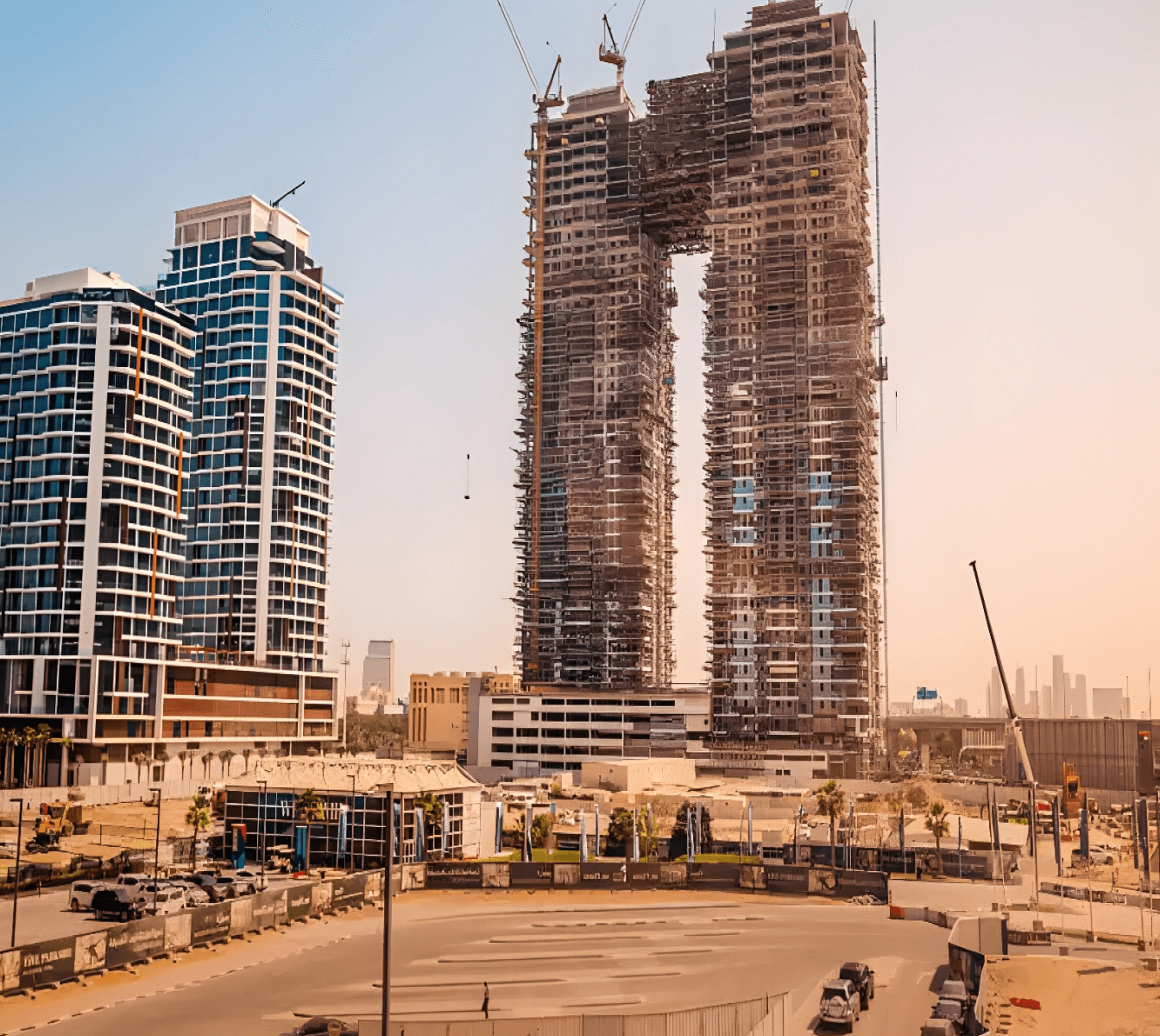

Off-plan property is real estate that is sold during the construction phase, or even before construction begins if there is only a development project.

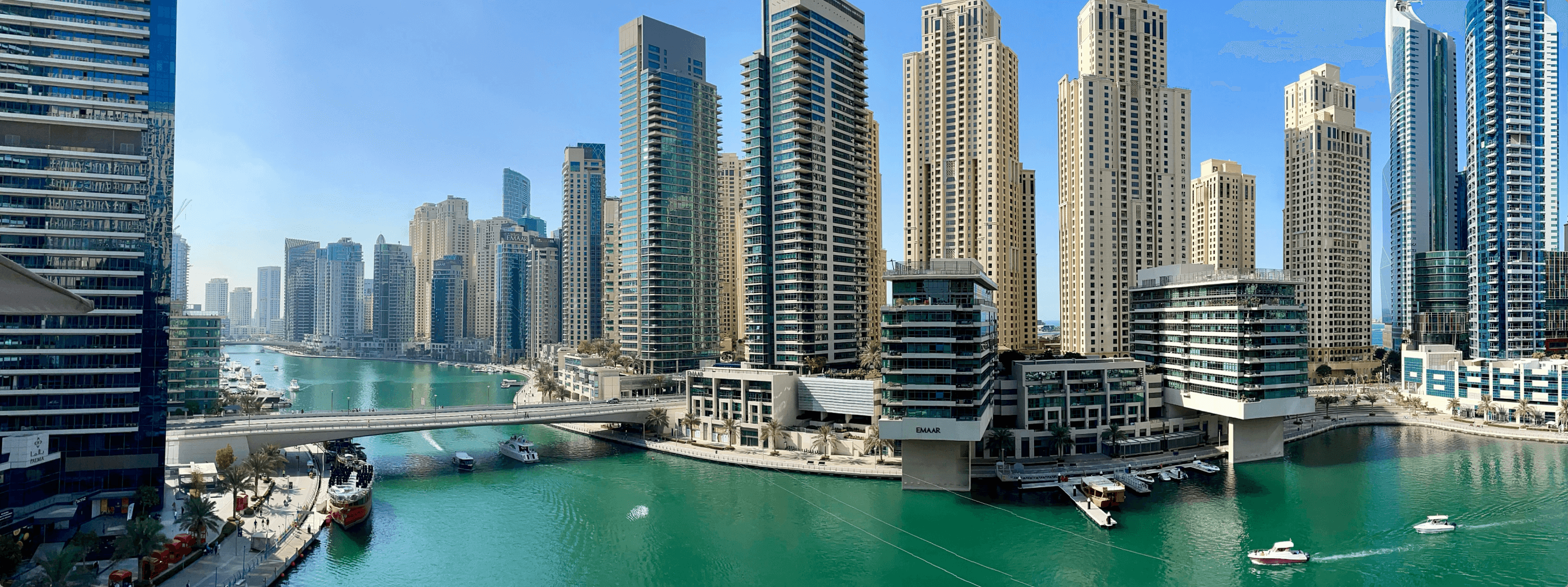

Essentially, the buyer buys the property "on paper" based on the developer's plans, layouts and design documents. This type of purchase has become popular in Dubai due to the construction boom.

What are the Advantages of Off-Plan Properties?

Off-plan properties in Dubai open up several opportunities for an investor:

- You get a substantial discount to the market price, compared to buying completed properties — often around ~20% below market. Given the stable growth of real estate prices in Dubai, this creates a good profitability potential.

- Developers usually offer a convenient installment plan that allows you to make payments gradually throughout the construction period. The down payment is often as little as 10-20% and you can pay the rest in installments during the construction period.

- Once the property is completed, you can expect a rental income of 5-8% per annum, which is higher than in many countries.

- You can choose real estate with optimal characteristics. In the secondary market, on the other hand, you often have to choose from what’s available. When investing in off-plan, you can select an apartment with a better view, location, or layout.

Buying off-plan properties in popular projects is a powerful investment tool. In prestigious locations, prices can increase by 20% or more before construction is completed, and the property can be resold after paying just 40% of its value.

What does this mean in practice? Let's look at a specific example. Suppose you're purchasing an apartment worth 2.5 million AED. Before you can sell it, you need to pay:

- First installment (20%): 500 thousand AED.

- Second installment (20%): 500 thousand AED.

Thus, you'll invest 1 million AED. If the market value of the property rises to 3 million AED, you can sell the property at a profit, receiving:

- Return of invested funds: 1 million AED.

- And 500 thousand AED in net profit.

This way, your investment will yield a 50% profit in just six months.

When to Choose Completed Real Estate and When to Choose an Off-Flan Property?

It depends on your investment goals, planning horizon and risk tolerance.

An off-plan is suitable if:

- You consider real estate as an investment — you plan to maximize profits through price appreciation during construction and favorable starting conditions from the developer.

- You are patient with the timing — you realize that construction and preparation of the property for occupancy or rental can take 4 years or more.

- Flexibility in payment is important to you — developers offer comfortable installments until the end of construction, which allows you to manage your investment budget more efficiently.

- You want the most modern solutions — in new projects developers introduce advanced smart home technologies and offer up-to-date layouts.

Completed real estate is suitable if:

- You want to use the property immediately — move in yourself or start earning rental income without a waiting period.

- You prioritize reliability — you prefer to pay more for a guaranteed result and no risks.

- It is important for you to see everything with your own eyes — to appreciate the quality of the finishes, the layout, the views and the atmosphere of the neighborhood.

What is Important to Consider?

Investing in off-plan projects is always associated with increased risk, but in Dubai it is lower than in many markets. The main risks are:

- Failure to meet deadlines. This can significantly affect your plans: postpone your move to a new apartment, delay the start of rental income or the moment you sell the property at a profit. In doing so, you will continue to incur mortgage repayment costs or miss out on alternative investment opportunities.

- Decline in market prices. In case of urgent need to sell, it may be more difficult to realize housing under construction than ready-made: during recessionary periods, buyers are less likely to consider objects at the construction stage because of increased investment risks. However, this mainly applies to the mass market segment. Luxury real estate is typically more resistant to market fluctuations — this category includes projects such as W Residences — JLT, Mandarin Oriental Residences, or Six Senses Residences Dubai Marina.

- Changes to the layout or materials. Because of this, the final project might not comply with the master plan. However, in Dubai, this rarely happens: the developer must agree to all significant changes with RERA (Real Estate Regulatory Agency).

- Falling for an unscrupulous developer. Fortunately, the Dubai government strictly controls the construction industry and protects investors, as we will discuss below.

How do Authorities Protect Off-Plan Investors?

The Real Estate Regulatory Authority (RERA) has set strict rules for developers:

- The land for construction must be wholly owned by the developer.

- The developer must either build 20% of the property or deposit 20% of the cost in a special account or provide a bank guarantee for this amount.

- Additionally, a performance guarantee of 10% is required.

There are other protections: all payments to the developer go through banks approved by the Dubai Land Department (DLD). The money is held in special escrow accounts and released in installments after an independent consultant confirms that each stage of the work has been completed.

Why is this necessary? The developer cannot use buyers' money for other projects or disappear from the market without fulfilling obligations.

How to Choose a Reliable Project?

When buying real estate at the construction stage, be sure to check the legal cleanliness of the project — this will protect your investment and help you avoid fraud:

- Make sure the project is registered with RERA (Dubai Real Estate Regulatory Authority). Also check if the developer has an escrow account.

- Check the reliability of the developer. It is better to choose trusted developers like Emaar, DAMAC or Dubai Properties. Study the history of their projects and how accurately they have met the construction deadlines.

- Study the location. Assess how the area will be developed: what roads, metro, schools or shopping centers will be built nearby. This is important both for comfortable living and for the growth of real estate value. Mira's experts have already thoroughly studied every district of Dubai and are ready to share up-to-date information — simply submit a request on our website, and a personal consultant will reach out.

Tip: check the project and the developer in the official Dubai REST app.

You can use it to check builders' licenses, register a sale, track construction progress and review legal documents for the property.

Fees and Expenses

You will need to pay 4% of the property value for registration with the Land Department and pay AED 3,000 for Oqood (registration).

The good news is that in order to attract buyers, developers often cover some of the costs. Some even pay the registration fee in full — this will save you at least 4% of the cost of the property.

Pros and Cons Compared

Here are the upsides and downsides to consider when investing in off-plan properties in the UAE:

Pros:

- The price is on average, 20% higher compared to already completed properties, which means that there’s great potential for increased ROI.

- Flexible terms: a small down payment and convenient payment schedule.

- After completion, renting the property out can generate a ROI of 5–8% per annum.

- Developers often reimburse some of the costs, including a 4% registration fee.

- Off-plan investments are less risky in Dubai than in other parts of the world thanks to strict government oversight.

Cons:

- Construction can take 4 and more years, meaning there is a long waiting period until you can use the property.

- Delays happen, which can make it impossible to earn income or settle in on schedule.

- Off-plan properties don’t sell as quickly as completed ones, especially during tricky market conditions, which drives up the risk-factor.

- After completion, the project may differ from the master plan.

- Additional due diligence is required to minimize risks, both for projects and developers.

Bottom line

Property values across Dubai continue their steep climb, with a yearly increase of about 20%. For buyers watching these trends, there's a notable advantage in the construction phase: new developments may cost 20% or more below completed properties in similar locations. This substantial price difference has turned unfinished properties into an appealing option for those planning long-term investments.

Such investments can bring good returns, but it is important to choose projects and developers carefully.

Before investing money, it is worth studying the market and consulting with experts. This will help you assess the opportunities and risks and make an informed decision.